- 7 17 Staff

What is a Credit Report and Why Should You Check It?

When you think about it, your credit report is probably the most important tool in your financial life: companies use it to make major lending decisions for you, it contains a wealth of your private information, and it can be vital to safeguarding yourself from identity theft. As such it’s pretty essential to regularly evaluate your credit report. Here’s a primer on what your credit report contains, why you should check it, and what to look for when you do.

What is a credit report?

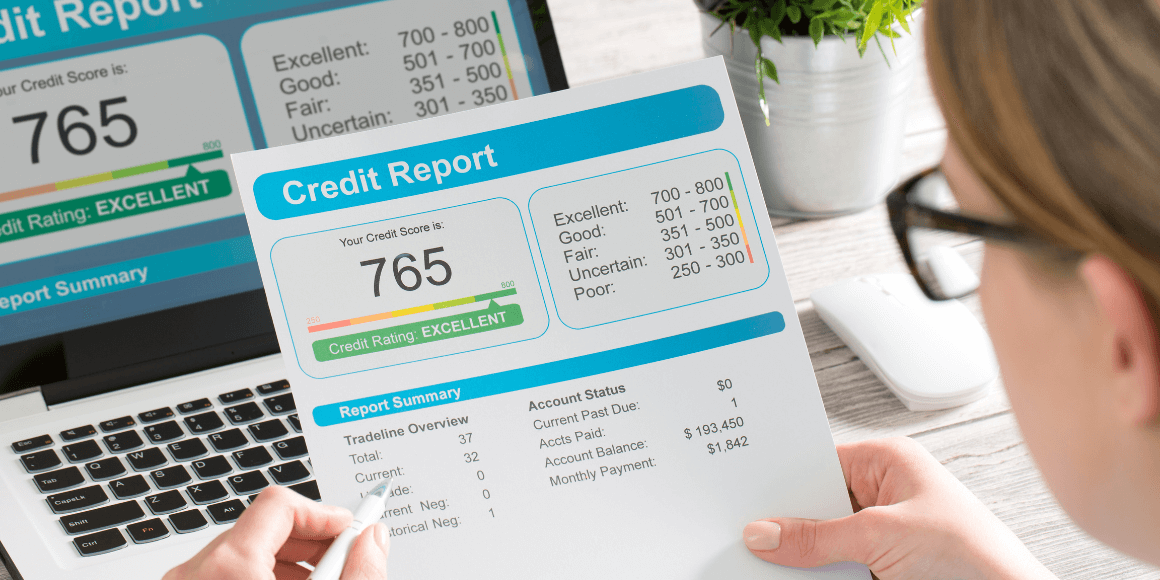

A credit report contains all information regarding your credit activity, credit history and credit status. This includes your loans, past and current; any credit cards in your name; details regarding your credit cards and loans; and any delinquencies or issues with your credit. All of these factors are used to determine your credit score, which your credit union, bank, or other companies use to make lending decisions for you.

Why should I check it?

First of all, it’s free, so there’s no real reason not to check it. Under the Fair Credit Reporting Act, everyone is entitled to one free credit report each year to check his or her financial health. We recommend using www.annualcreditreport.com to obtain it. BEWARE: there are similarly named sites out there that offer a free credit report, BUT you have to enter your credit card number, which will be charged $1 to grant you access to your report. A monthly monitoring fee will also be charged to your card if you do not cancel within a certain time period.

You should also check it as a refresher on your total financial picture. By knowing where you stand credit-wise, you won’t be surprised if you are denied for a loan. It’s also a handy guide in helping you tailor your financial choices for a better credit score down the road.

Perhaps most importantly, your credit report can be an early detector of identity theft or fraud. Because it contains all of your credit information and more, you can verify each creditor listed, each job you’ve had and each address that you’ve lived at. If there is something you don’t recognize or that seems suspicious, it could be an indicator of identity theft.

What is in it?

In a nutshell, your credit report includes everything that makes up your total credit score.

You will find:

- Your identifying information, including your social security number, date of birth, current and past places of residence, and current and past places of employment.

- All current and past credit card accounts and loans; their status; their type; whether you are a joint or sole owner, or authorized user; and your credit limit or loan amount.

- Negative information, if any, including liens, late payments and any payment agreements that have not been kept.

- Credit inquiries over the past two years.

- Any public records pertaining to your credit history, including liens and civil judgments.

What should I look for?

Review each section for accuracy. Even the smallest detail – a misreported credit limit, for example – can have a great impact on your future financial decisions. The folks at TransUnion have a great infographic that breaks down the report and provides guideposts for your review. If you find inaccuracies, you can dispute them with the credit reporting agencies who then have 30 days to respond.

Make sure that your personal information is correct as well as the loans or credit cards reported. Major inaccuracies, such as addresses you don’t recognize, jobs that you never held, or accounts you didn’t open, are often the early signs of identity theft and should be treated as a red flag. If you find such information, it’s in your best interest to reach out to the three credit reporting agencies and file either a credit freeze or fraud alert on your accounts.

You can also look for areas to improve. For example, do you have a large amount of revolving debt? Perhaps you can looks for ways to pay that amount down more quickly to improve your score. Do you notice that you have more late payments than you thought? Set up automatic payments to assure that you never forget a due date.

Now that you have all of this information in hand, it’s time to request your credit report and take control of your financial life!